What Is Job Costing in Construction A Practical Guide to Profitability

Job costing is a simple idea that’s incredibly powerful in practice. It’s the process of tracking every single dollar you spend on a specific project—from materials and labor to equipment and even a slice of your overhead. Think of each job as its own little business with its own bank account. This is how you find out which projects are actually making you money and which ones are secretly bleeding you dry.

What Is Job Costing in Construction?

Let's say you're an HVAC contractor handling a full system installation. Without job costing, you see a nice, big check at the end and assume you did well. With job costing, you see the whole story. You know exactly what the furnace cost, how much you spent on copper lines, the precise wages for the technicians on that job, and even the portion of your shop's rent that project should cover.

This isn't just for the big general contractors running multi-million dollar sites. It’s absolutely critical for trade businesses—plumbers, electricians, HVAC pros, you name it. It’s the only way to shift from hoping a job is profitable to knowing it is.

Once you have that clarity, you can make much smarter decisions.

- Pinpoint Your Moneymakers: You might discover that commercial repair jobs are far more profitable for you than new residential installs.

- Sharpen Your Bids: Your estimates for new work will be based on hard data from past projects, making them competitive and, more importantly, profitable.

- Catch Budget Creep Early: You can see when labor hours or material costs are starting to balloon before the job is finished and it's too late.

Job costing is the financial heartbeat of a construction project. It gives you the real-time data you need to keep a job healthy, on budget, and profitable. It transforms guesswork into a solid financial strategy.

From Post-War Boom to Modern Practice

The idea of tracking costs this carefully isn't new. It really took hold during the construction boom after World War II. The industry was exploding, and contractors without a tight grip on their costs were getting crushed by overruns. In fact, historical data shows that poor cost tracking was a major reason 20-30% of projects in that era went over budget by at least 15%.

For anyone serious about getting their finances in order, a solid contractor's guide to bookkeeping and job costing is a must-read.

The good news? What used to be a nightmare of spreadsheets and paperwork is now much, much easier. Modern software has brought this level of financial control to everyone. Tools like TackonFSM do the heavy lifting for you, capturing costs from the field as they happen and cutting out manual data entry. Now, even a two-person team can manage their job costs with the same precision as a giant firm, making sure every project pulls its weight.

Understanding the Three Pillars of Job Costing

To get job costing right, you first need to know where every single dollar fits. Think of it like organizing your work van—everything has its place. In accounting, this means sorting every expense into one of three main buckets: direct costs, indirect costs, and overhead.

Nailing this down is the foundation of knowing your true profit on any given job. When you see exactly where the money is going, you can build much more accurate estimates, protect your margins, and just flat-out make smarter decisions for the business. Let's break down each one with real-world examples that trade contractors see every single day.

Pillar 1: Direct Costs

Direct costs are the easiest expenses to wrap your head around. These are costs that can be tied directly to a single, specific job. If you can point to a project on the schedule and say, "I only spent this money because of that job," it's a direct cost.

For a plumbing, electrical, or HVAC business, these are the costs you live and breathe every day.

- Materials: This isn't just the big stuff like a new furnace or water heater. It's every single fitting, valve, and foot of copper pipe pulled from the van for that specific installation.

- Labor: This is what you pay your technician for the exact hours they spend on-site, including the time it took to drive to that customer's location.

- Subcontractors: Did you need to hire an electrician to run a new circuit for that A/C unit you installed? Their invoice for that specific task is a direct cost to your project.

- Equipment Rentals: Renting a mini-excavator for a one-off sewer line replacement is a textbook direct cost.

Tracking these accurately is the core of what is job costing in construction. Every part and every minute has to be accounted for to know a job's true cost.

A classic mistake is ignoring the small stuff. A few screws here or a roll of Teflon tape there might seem like nothing, but over hundreds of jobs, these little "ghost costs" can chew away thousands of dollars from your bottom line.

Pillar 2: Indirect Costs

Indirect costs are a little trickier. Sometimes called job-related overhead, these are expenses that are still necessary for a specific job but aren't as simple to assign as a part number or an hour of labor. They support the project without being a physical piece of the final product.

Think of them as the behind-the-scenes crew for your direct costs.

- Permit Fees: The fee you pay the city for a new furnace permit is for that job and that job alone, but it’s not a physical part or a labor hour.

- Project Management: If a supervisor spends a few hours specifically planning and overseeing a large commercial HVAC install, that time is an indirect cost for that project.

- Job-Specific Insurance: Sometimes a project requires a special insurance rider or bond. That cost is tied directly to that one job, making it an indirect cost.

- Site-Specific Supplies: Things like protective floor coverings, safety cones, or specialty saw blades used exclusively at one customer's home fall into this category.

Separating these costs gives you a much clearer picture of what it really takes to get a job done right, from start to finish.

Pillar 3: Overhead Costs

Finally, we have overhead costs. These are all the expenses required to keep your business running, whether you have one job on the books or one hundred. They are the fixed, ongoing costs that don't belong to any single project but have to be paid just to keep the lights on and the doors open.

Since they can't be tied to one job, you have to find a fair way to spread them across all of your jobs.

Common overhead costs usually include:

- Rent for your office and shop

- Salaries for office staff (like dispatchers and bookkeepers)

- Utilities (electricity, internet, phone bills)

- General business and vehicle insurance

- Software subscriptions (like your field service management platform)

- Marketing and advertising costs

This level of detail is critical. Between 2015 and 2023, construction prices for nonresidential work in the U.S. shot up by 52%. That kind of inflation turns precise job costing from a "nice-to-have" into a "must-have" for survival. To get a better sense of the market, you can explore more on these construction industry trends.

Job Costing Formulas Every Contractor Should Know

Knowing the difference between direct, indirect, and overhead costs is great, but that knowledge doesn't pay the bills. You have to put it to work. That’s where a few essential formulas come in, turning those abstract cost categories into hard numbers that reveal the true financial story of every single job.

Getting comfortable with these calculations is the difference between guessing and knowing. It's how you build a business on a solid foundation of data. Let's break down the most important formulas using an example we can all picture: a residential furnace replacement.

Calculating Job Profitability

This is the big one. The final score. It tells you exactly how much money you actually made on a project after every single cost—from the furnace itself to your office rent—is accounted for. It’s the clearest way to answer the question, "Was this job really worth our time?"

The formula looks simple, but its power comes from how accurately you've tracked your numbers.

Job Profitability Formula:

Total Job Revenue – (Direct Costs + Indirect Costs + Allocated Overhead) = Job Profit

Let's plug in the numbers from our furnace replacement:

Example Furnace Replacement:

- Total Job Revenue (what you invoiced): $6,500

- Direct Costs (new furnace, piping, etc.): $3,200

- Direct Labor (tech’s wages for this job): $800

- Indirect Costs (the permit fee): $150

- Allocated Overhead (the job's share of shop rent, utilities, etc.): $550

Now, let's do the math:

$6,500 - ($3,200 + $800 + $150 + $550) = $1,800

The job delivered a profit of $1,800. This number is your north star. It gives you a clear picture of performance that the top-line revenue of $6,500 never could on its own.

Determining Your True Labor Burden Rate

Here’s a mistake that sinks profits faster than almost anything else: calculating labor cost using only a technician's hourly wage. That simple wage ignores a mountain of other costs like payroll taxes, workers' comp, and benefits. The Labor Burden Rate calculates the actual all-in cost for every hour an employee is on the clock.

Knowing this number is non-negotiable for pricing jobs correctly.

Labor Burden Rate Formula:

(Total Employee Cost / Total Workable Hours) = Labor Burden Rate

Let’s figure this out for a tech who earns $35 per hour:

-

Calculate Total Annual Employee Costs:

- Annual Wage: $35/hour * 2,080 hours = $72,800

- Payroll Taxes (FICA, etc.): $5,569

- Workers' Comp Insurance: $2,500

- Health Insurance Contribution: $4,000

- Total Annual Cost: $84,869

-

Calculate Annual Workable Hours:

- Total Hours in a Year: 2,080

- Less: Vacation (80 hrs), Holidays (40 hrs), Sick Time (40 hrs) = 160 hours

- Total Workable Hours: 1,920

-

Calculate the Labor Burden Rate:

$84,869 / 1,920 hours = $44.20 per hour

Suddenly, that $35/hour technician actually costs your business $44.20 per hour. If you price your jobs using $35, you're underbidding every single time and quietly losing money.

Figuring Out Your Overhead Allocation Rate

Finally, you need a fair and consistent way to make sure every job helps pay for your general business expenses—the overhead. An Overhead Allocation Rate spreads these costs across all your projects, so each one carries its own weight. A common way to do this is to calculate overhead as a percentage of your direct costs.

First, add up your total annual overhead: rent, utilities, office salaries, software like TackonFSM, and so on. Let's say your annual overhead is $120,000.

Next, calculate your total annual direct costs (all materials and direct labor). We'll estimate that at $500,000.

Overhead Allocation Rate Formula:

(Total Annual Overhead / Total Annual Direct Costs) * 100 = Overhead Rate

Using our example:

($120,000 / $500,000) * 100 = 24%

This tells you that for every dollar you spend on direct costs for a job, you need to add another 24 cents just to cover your overhead. This simple calculation ensures you aren't accidentally paying for your business operations out of your own pocket.

How to Implement Job Costing in Your Business

Moving from theory to practice can feel like a massive leap, but getting started with job costing doesn't have to mean tearing your business apart and starting over. The trick is to break the process down into manageable steps. If you start simple, build good habits, and use the right tools, you can get powerful financial insights without throwing your daily workflow into chaos.

Think of this as a practical roadmap for putting job costing to work in your trade business. It’s less about a rigid set of rules and more about a clear path to follow—one that leads to more accurate quotes, tighter cost control, and healthier profit margins on every single job.

Step 1: Structure Your Chart of Accounts

Before you can track a single penny, you need a place to put it. This all starts with your Chart of Accounts in your accounting software. Instead of lumping everything into one giant expense account called "Materials," you need to create sub-accounts or tags that let you assign each purchase to a specific project.

Most modern accounting platforms, like QuickBooks, are built for this. The goal is simple: make it easy to assign every dollar you spend—whether it's on a box of screws or a city permit—directly to the job it belongs to. Getting this foundation right from the start keeps your data clean and organized.

Step 2: Capture Costs from the Field

Let's be honest: your most important cost data isn't generated in the office. It happens out in the field. If you’re still relying on technicians to remember their hours or turn in a pocketful of crumpled receipts at the end of the week, your job costing is dead on arrival. The only way to get accurate data is to capture it in real-time.

This is where a Field Service Management (FSM) platform becomes a game-changer.

- Mobile Time Tracking: Your techs should be clocking in and out of jobs right from their phones. This captures precise labor hours, including travel time, and automatically ties them to the correct project. No more guesstimates.

- Digital Parts Tracking: When a technician pulls a part from their van stock, they should log it in their mobile app on the spot. This immediately links the material cost to the job, making sure nothing gets forgotten or accidentally given away for free.

By making data capture a simple, seamless part of your crew's daily routine, you eliminate the guesswork and ensure every single cost gets accounted for.

Step 3: Calculate Your Burden and Overhead Rates

As we covered earlier, understanding your true labor and overhead costs is non-negotiable. If you haven't already, take the time to run the numbers using the formulas for Labor Burden Rate and Overhead Allocation Rate. This isn't a one-and-done task; you should revisit these calculations at least once a year, or anytime your business costs change significantly—like a rent increase or a jump in your insurance premiums.

Don't skip this step. Using an accurate, data-backed rate to allocate your indirect costs is the only way to build quotes that are actually designed for profit. Without it, you're just throwing darts in the dark.

Step 4: Automate Data Entry and Reporting

Historically, the biggest obstacle to good job costing has been the sheer amount of manual work involved. Chasing down timesheets, matching supplier invoices to jobs, and plugging numbers into spreadsheets is a huge time-suck and a recipe for errors. Thankfully, automation can handle the grunt work for you.

This is where a platform like TackonFSM completely changes the game. By integrating scheduling, dispatch, parts management, and invoicing into one system, it connects every action in the field directly to the financial side of the job.

This screenshot from TackonFSM's homepage gives you a sense of how a unified dashboard pulls everything together.

With a centralized system, when a tech logs their time or uses a part, that data flows automatically into the job's financial record. This completely eliminates the need for your office staff to re-enter everything by hand.

Trying to decide between sticking with spreadsheets and adopting a dedicated software? The choice becomes pretty clear when you see the differences side-by-side.

Manual Spreadsheets vs. FSM Software for Job Costing

| Feature | Spreadsheets | TackonFSM |

|---|---|---|

| Data Entry | 100% manual. Relies on techs reporting hours/parts and office staff keying it in. | Automated. Time and parts are logged in the field via mobile app and sync instantly. |

| Accuracy | High risk of error. Prone to typos, forgotten entries, and calculation mistakes. | High accuracy. Eliminates manual entry, reducing human error significantly. |

| Real-Time Data | Delayed. Reports are only as current as the last time someone updated the sheet. | Instant. Job costs are updated in real-time as work happens. |

| Labor Tracking | Guesswork. Often relies on handwritten timesheets or memory. | Precise. GPS-enabled mobile clock-in/out captures exact hours per job. |

| Integration | Isolated. Completely disconnected from scheduling, invoicing, and inventory systems. | Fully integrated. Connects all field operations, from dispatch to final invoice. |

| Reporting | Time-consuming. Building reports requires manually pulling data from multiple sources. | On-demand. Generate detailed job cost reports with a few clicks. |

While spreadsheets might feel free, the hidden costs in wasted time, inaccurate data, and lost profits add up fast. An FSM platform is an investment in efficiency and accuracy that pays for itself.

Step 5: Create a Routine for Review

Finally, all this data is useless if you never look at it. The last step is to build a simple, consistent habit of reviewing your job cost reports. You don’t need to obsess over every job every day, but setting aside dedicated time on a regular basis is essential.

Start with a simple weekly or bi-weekly review:

- Check Budgets on Active Jobs: Take a quick look at projects currently in progress. Are your labor hours or material costs creeping up higher than you estimated? Catching a problem early gives you a chance to get back on track before the job is finished and your margin is gone.

- Analyze Recently Completed Jobs: As soon as a job is done, review the final numbers. Which ones were your big winners? Were there any that barely broke even or lost money?

- Identify Trends: Over time, you’ll start seeing patterns. Are certain types of services always more profitable? Does one of your technicians consistently bring jobs in under budget? Use these insights to fine-tune your pricing, improve your training, and focus your business on the work that actually makes you money.

Common Job Costing Mistakes and How to Avoid Them

Even with the best of intentions, a lot of contractors stumble when they first start job costing. The result? Frustratingly inaccurate numbers that can make the whole process feel like a waste of time. These small errors have a way of snowballing, but the good news is they're incredibly common and completely avoidable once you know what to look for.

Getting ahead of these pitfalls is the secret to building a reliable job costing system. By understanding where things usually go wrong, you can build a process that gives you the financial clarity and actionable insights you need right from the start.

Inaccurate Field Data Capture

If there’s one thing that will torpedo your job costing efforts, it’s bad data coming in from the field. When the information is unreliable at the source, every report you run and every calculation you make will be just as flawed. This problem usually rears its head in two key areas.

First up is inaccurate labor tracking. Let’s be real—if your techs are guessing their hours at the end of the day or filling out paper timesheets a week later, you aren't working with real numbers. An hour forgotten here or an extra 30 minutes added there might seem small, but it adds up fast and completely destroys the accuracy of your profitability calculations. The fix is simple: give your team a mobile app with a built-in time clock. When they can clock in and out of jobs right on their phones, labor hours are captured precisely and tied to the right project automatically.

The second culprit is forgetting small materials. It's easy to remember to bill for the new furnace, but what about all the screws, wire nuts, and sealant that came out of the van? These "consumables" can bleed profits dry if they aren't tracked. An inventory system that lets techs digitally log every single part used—no matter how small—ensures those costs are always captured and billed.

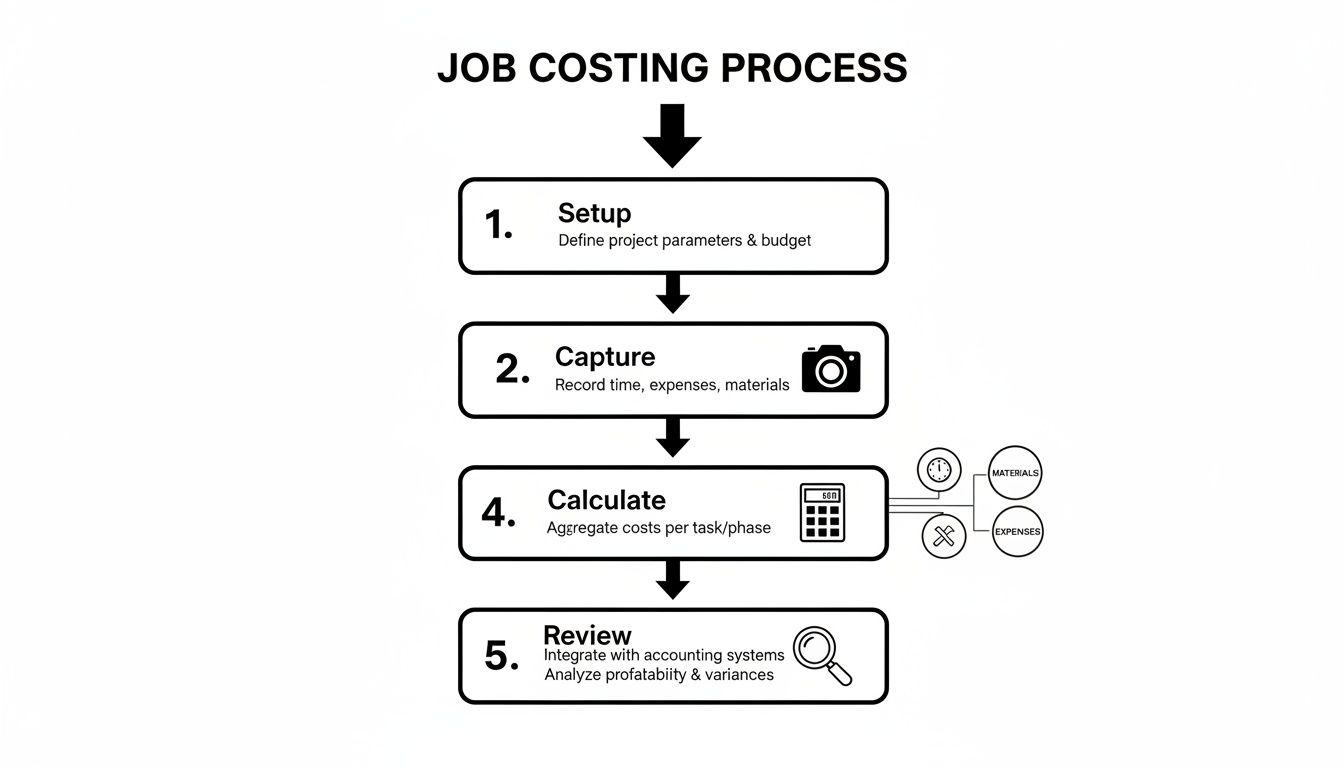

This flowchart lays out the core steps for a solid job costing workflow, from getting set up to the final review.

Using the right tools to automate the "Capture" and "Calculate" steps is the most surefire way to prevent the common slip-ups that derail manual systems.

Miscalculating Overhead and Burden

Another huge mistake is either miscalculating or completely ignoring overhead and labor burden. Many contractors fall into the trap of pricing jobs based only on materials and a tech's hourly wage, which is a recipe for underbidding. This oversight means you aren't actually accounting for the true cost of running your business or having that employee on your payroll.

Solution: Don't skip the math. Take the time to calculate your true Labor Burden Rate and Overhead Allocation Rate at least once a year. These figures are your secret weapon, ensuring that every estimate you build includes a fair share of your operating costs and protecting your profit margins on every single job.

The impact of poor costing is a global problem. With global construction costs jumping by 4.15% in 2024 and project overruns becoming the norm, precise data is non-negotiable for survival. You can learn more about these global construction cost trends and see how they're affecting businesses everywhere.

By dodging these common errors, you can move from just tracking expenses to making smart, data-driven decisions that fuel real, sustainable growth.

How TackonFSM Automates Your Job Costing Process

Knowing the formulas is one thing, and avoiding the pitfalls is another. But let's be honest—the real grind of job costing is the day-to-day work. You’re wrestling with spreadsheets, chasing down timesheets, and trying to match a mountain of invoices to the right jobs. It’s a massive time sink and a breeding ground for costly errors.

This is where the right software doesn't just help; it completely changes the game.

Instead of job costing being a painful, after-the-fact accounting chore, a platform like TackonFSM weaves it directly into your daily operations. Every single action your crew takes—clocking in, using a part, logging travel time—instantly updates the job's financial picture. This kills the manual data entry that drives everyone crazy and gives you a live, up-to-the-minute view of where you’re making or losing money.

This is what it looks like in practice. All the crucial numbers are right there in your hand, accessible from the job site, the truck, or the office. With this kind of integration, you stop reacting to month-old reports and start making smart decisions based on what’s happening right now.

Seamlessly Track Every Cost from the Field

Good job costing is built on one simple rule: capture every penny. That process has to start with your team on the ground. TackonFSM was designed from the ground up to make this dead simple by turning every technician's phone into a cost-tracking tool.

- Automated Labor Tracking: Techs clock in and out of jobs directly on the mobile app. It captures their exact hours, logs travel time, and assigns it all to the correct project code. No more guesstimates or trying to decipher scribbled timesheets at the end of the week.

- Real-Time Parts Management: When a technician pulls a part from their truck, they log it in the app on the spot. This immediately updates your inventory records and—more importantly—assigns that part's cost directly to the job. Every screw, fitting, and filter gets accounted for.

This direct link between what happens in the field and your financial records means your job cost data is always accurate and current. And the best part? It doesn’t create any extra work for your office staff.

Gain Instant Profitability Insights

Once all your cost data is flowing into one place, you can finally stop wasting hours crunching numbers and building reports by hand. TackonFSM does the heavy lifting for you, automatically organizing the information to give you a real-time dashboard on the financial health of every single job.

You can see at a glance which types of jobs are your biggest money-makers, which technicians are knocking it out of the park, and even which customers are the most profitable to work for. Trying to get this level of insight from a spreadsheet is a nightmare. As technology continues to evolve, these capabilities are becoming even more powerful; for a closer look, you can explore the growing impact of AI in accounting.

By automating the tedious work of data collection and calculation, TackonFSM frees you to focus on what actually matters: using the data to make smarter decisions, refine your pricing strategy, and drive profitable growth.

This is a fundamental shift in how you run your business. You move from being a bookkeeper to a strategist. Instead of asking, "How did we do last month?" you can start asking, "How can we be more profitable next week?" The answers are right there in the data, updated in real time.

Got Questions About Job Costing? We've Got Answers.

Alright, so we've covered the what and the why of job costing. But as with anything in the real world, the devil is in the details. Let's tackle a few common questions that pop up when contractors start putting these ideas into practice.

How Often Should I Actually Look at These Reports?

For job cost reports to do you any good, you have to look at them—and often. Tucking them away until the end of the quarter is like checking the rearview mirror after you've already hit the guardrail. It only tells you what went wrong, not how to avoid it.

As a rule of thumb, a weekly review is a great place to start. This cadence is frequent enough to let you:

- Keep tabs on active jobs: See a budget creep on labor or materials? You can jump on it now, not a month from now when it’s a disaster.

- Debrief on finished jobs: Analyze your profit margins while the project is still fresh in everyone's mind. What went right? What went wrong?

- Spot important trends: You might notice certain types of jobs are consistently more profitable, or that one of your technicians is a rockstar at staying under budget.

Ultimately, the goal is to get as close to real-time as possible. When your data is constantly updated, you're making decisions based on today's reality, not last month's history lesson.

What's the Difference Between Job Costing and Process Costing Anyway?

This is a great question because it gets right to the heart of why job costing is so perfect for the trades. Both methods track costs, but they're built for completely different worlds.

Job costing is all about unique, one-off projects. Think of a custom kitchen remodel, a new deck, or a complex HVAC installation. Each one is a distinct beast with its own specific materials, labor, and challenges. The whole point is to figure out the profit on that specific job.

Process costing, on the other hand, is for mass production. Imagine a factory churning out thousands of identical widgets. They aren't trying to find the cost of Widget #742; they're calculating the average cost to produce a single widget across the entire production run. One is for custom work, the other is for cookie-cutter manufacturing.

Can I Get Started Without Shelling Out for Fancy Software?

You absolutely can. For a small contractor juggling just a handful of jobs at a time, a well-organized spreadsheet is a fantastic starting point. It gets you into the crucial habit of tracking every dollar without an upfront cost.

Just know what you're getting into. The trade-off for "free" is your time and a higher risk of human error. As your business grows, those spreadsheets will start to feel like you're trying to build a house with a Swiss Army knife. You'll be buried in manual data entry, and because the information isn't live from the field, you're always looking at slightly outdated numbers.

Starting with spreadsheets is a smart, lean way to begin. But when you're ready to grow and need accuracy you can count on, investing in a proper system is the next logical step.

Ready to ditch the spreadsheet headaches and see your job profitability in real-time? TackonFSM was designed specifically for trade contractors to get a firm grip on their numbers, from estimate to final payment. See how TackonFSM can simplify your job costing.